Knowing how to hire loan officer talent becomes essential when lending decisions shape customer trust and business risk. A capable officer evaluates applications with balance, explains terms clearly, and maintains documentation discipline. This guide outlines a structured hiring approach to help HR identify Loan Officers who deliver consistent judgment across daily lending responsibilities.

What is a Loan Officer?

A Loan Officer evaluates applications, guides customers through lending steps, and ensures documents meet policy requirements. Their role becomes essential when businesses rely on accurate assessments, clear explanations, and disciplined follow-through. Strong officers balance customer expectations with risk controls, helping organisations maintain steady lending outcomes and operational clarity.

Quick tip: Use a Loan Officer job description template that sets clear expectations around customer handling, documentation accuracy, and lending judgment—top performers often look for this clarity before applying.

Where to Find the Best Loan Officer Candidates?

Finding dependable Loan Officer candidates requires channels that attract professionals experienced in customer evaluation, documentation accuracy, and lending conversations. Strong profiles often come from environments where officers handle steady application volumes and maintain disciplined verification routines.

Targeting these pools helps HR uncover candidates who balance customer guidance with lending risk and follow established processes without deviation.

- Banking and lending-focused job boards

- LinkedIn groups for credit and loan operations professionals

- Internal promotions from credit analysts or junior loan officers

- Referrals from branch managers and regional lending heads

- Talent platforms with lending, sales, and documentation-focused profiles

How to Screen for Good Loan Officer Candidates?

Screening a Loan Officer requires a structured method that highlights judgment, documentation discipline, and comfort with lending conversations. A clear sequence helps HR filter candidates who can evaluate applications accurately, explain terms with clarity, and maintain verification standards under daily pressure. Each step strengthens shortlist quality and reduces uncertainty during final selection.

- AI resume parsing and outreach using AI Recruit to identify lending experience

- Skills assessment focused on application review, risk signals, and documentation steps

- AI video interviewing to evaluate communication clarity and customer-handling style

- Taking the final call through HR-led review of lending judgment and process discipline

How to Assess Skills of Loan Officers?

Assessing Loan Officers requires an approach that reveals how they evaluate applications, guide customers, and maintain documentation accuracy. The role demands disciplined verification, steady communication, and sound judgment when assessing risk. A structured assessment helps HR understand how candidates prioritise tasks, interpret financial cues, and manage lending conversations under pressure without compromising process standards.

What Soft Skills Are Important for Loan Officers?

Soft skills influence how Loan Officers handle customer expectations, explain terms, and keep discussions grounded in policy. These behaviours shape daily interactions and lending outcomes.

- Clear and patient communication

- Calm handling of customer concerns

- Fair approach to application guidance

- Consistent follow-through on verification

- Accountability during documentation steps

Hard Skills of Loan Officers That You Must Test

Hard skills determine how well candidates manage application reviews, detect risk signals, and maintain compliance. These abilities form the foundation of reliable lending decisions.

- Application and income verification accuracy

- Understanding of credit evaluation steps

- Familiarity with lending policies

- Ability to detect incomplete or risky files

- Documentation and record-keeping discipline

Pro Tip: Use a Loan Officer test with realistic lending scenarios to reveal how candidates think when decisions require speed and care.

How to Interview a Loan Officer?

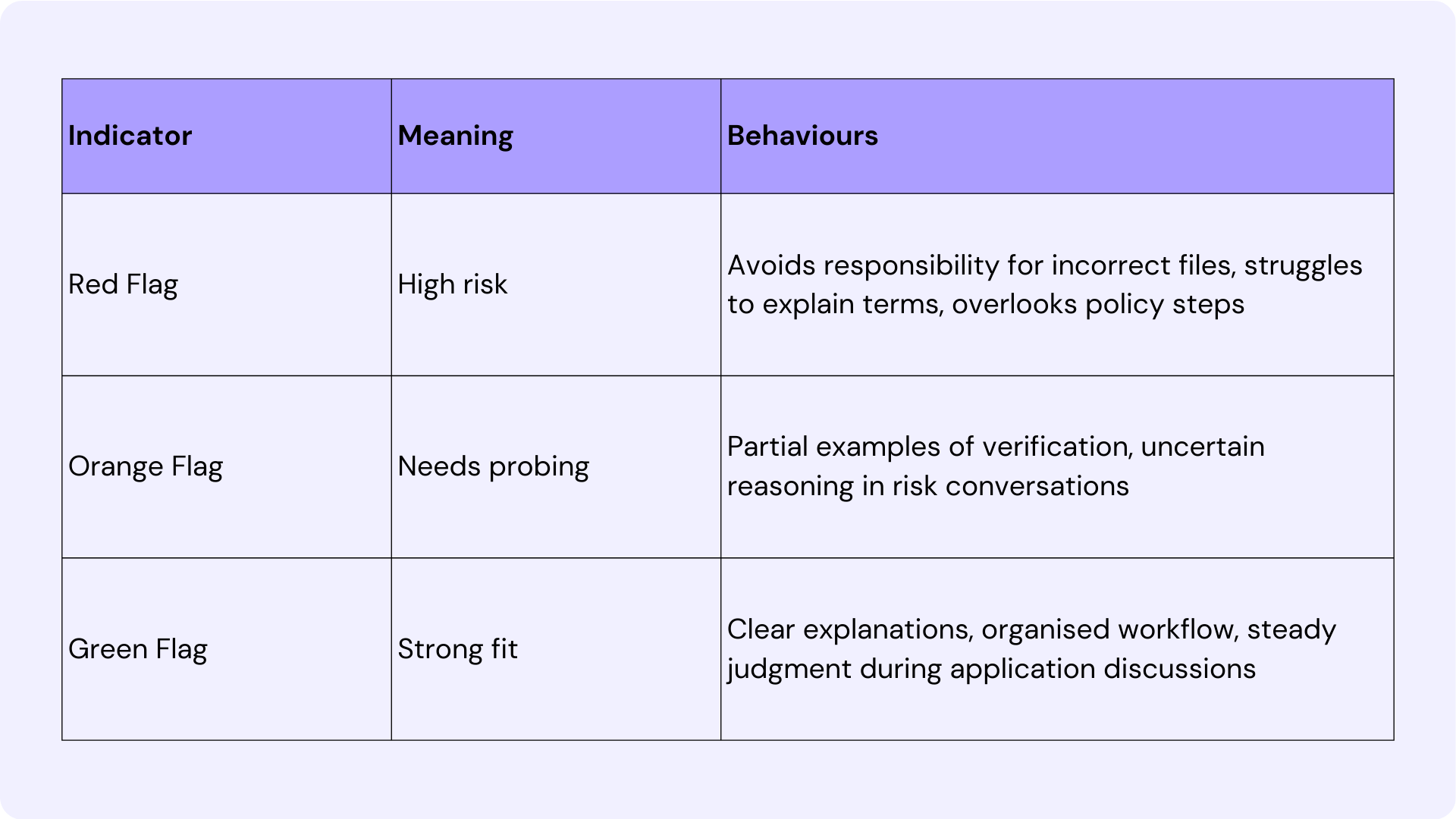

Interviewing a Loan Officer requires prompts that reveal how candidates explain loan terms, manage customer expectations, and maintain discipline during documentation steps. Use situational questions to uncover their judgment when assessing risk, handling objections, or spotting incomplete files. A structured table helps HR teams interpret behaviour and identify candidates who can balance customer guidance with compliance and lending standards.

Pro Tip: Use targeted Loan Officer interview questions to see how candidates think when lending decisions require calm, accurate communication.

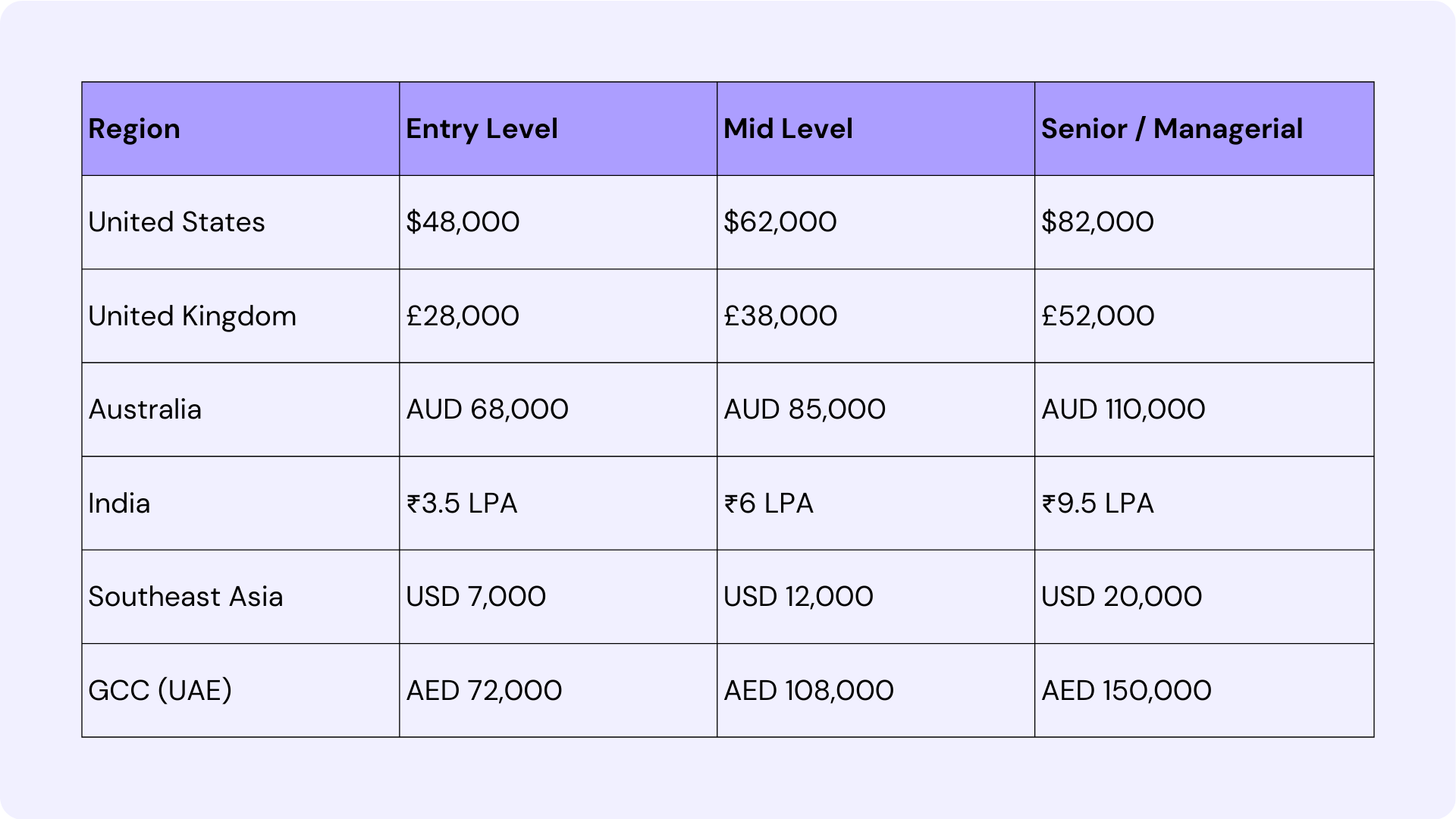

How Much Does a Loan Officer Cost?

Budgeting for a Loan Officer requires awareness of compensation differences across regions, lending sectors, and experience levels. Salaries shift based on responsibility scope, application volume, and compliance expectations. Using a structured benchmark helps HR maintain internal parity, design competitive offers, and support predictable hiring decisions across branches or lending teams.

Conclusion

Hiring a Loan Officer shapes how smoothly applications move through your lending process. The right choice brings steady judgment, clear communication, and disciplined verification. If your team needs structured support to evaluate lending roles with consistency, connect with PMaps at 8591320212 or assessment@pmaps.in for aligned assessment solutions.

.png)