Hiring the right investment banker is crucial when complex deals require careful analysis and sound judgment. A skilled banker manages transactions, helps clients make financial decisions, and works well under tight deadlines. This guide offers a clear process for finding investment bankers who deliver clarity, discipline, and dependable results.

What is an Investment Banker?

An Investment Banker helps clients raise capital, handle mergers and acquisitions, and manage financial restructuring. Their expertise is especially important when deals require careful analysis, accurate modeling, and clear communication. Good bankers keep deals moving, work with all parties involved, and help clients make important financial decisions with sound judgment and dependable follow-through.

Quick Tip: Attract top candidates by crafting a clear, focused Investment Banker job description.

Where to Find the Best Investment Banker Candidates?

To find strong Investment Banker candidates, use sourcing channels that attract people with skills in financial modelling, deal execution, and client communication. The best candidates usually work in places where long hours, tight deadlines, and structured analysis are part of the job. Focusing on these talent pools helps HR connect with candidates who can handle complex transactions with discipline and clarity.

- Investment banking and finance-focused job boards

- LinkedIn groups for M&A, ECM, DCM, and corporate finance professionals

- Internal promotions from analysts or associates

- Referrals from deal teams, advisory firms, or finance leadership

- Talent platforms with capital markets and transaction-focused profiles

How to Screen for Good Investment Banker Candidates?

To screen investment banker candidates, focus on their analytical skills, deal experience, and communication abilities. A clear process helps HR find people who can handle complex financial tasks, explain their reasoning, and work well under pressure. Each step makes hiring for important deals more reliable.

- Start by using AI tools to review resumes and reach out to candidates with relevant transaction experience.

- Next, assess candidates’ skills in financial modeling, valuation, and their ability to reason through deals.

- Then, use AI video interviews to see how clearly candidates communicate, how composed they are, and how they might interact with clients.

- Finally, have HR review the top candidates to make sure they meet the required analytical and communication standards before making a decision.

How to Assess Skills of Investment Bankers?

To assess investment bankers, focus on how they handle financial analysis, manage client expectations, and execute deals under tight deadlines. Look for disciplined modeling, clear communication, and sound judgment. A structured assessment lets HR see how candidates interpret data, lead discussions, and stay accurate during fast-paced deals.

What Soft Skills Are Important for Investment Bankers?

Soft skills shape how bankers communicate with clients, negotiate, and work with their teams. These abilities can speed up transactions and clarify communication.

- Calm reasoning during high-pressure deadlines

- Clear communication in client discussions

- Structured approach to explaining assumptions

- Steady coordination with deal teams

- Accountability in follow-through

Hard Skills of Investment Bankers That You Must Test

Hard skills show if a candidate can analyze deals, review financial information, and handle processes accurately.

- Financial modelling accuracy

- Valuation understanding across methods

- Ability to analyse financial statements

- Familiarity with deal processes and timelines

- Strong documentation and data consistency

Pro Tip: Use an Investment Banker Test based on real transaction scenarios to see a candidate’s judgment and analytical skills.

How to Interview an Investment Banker?

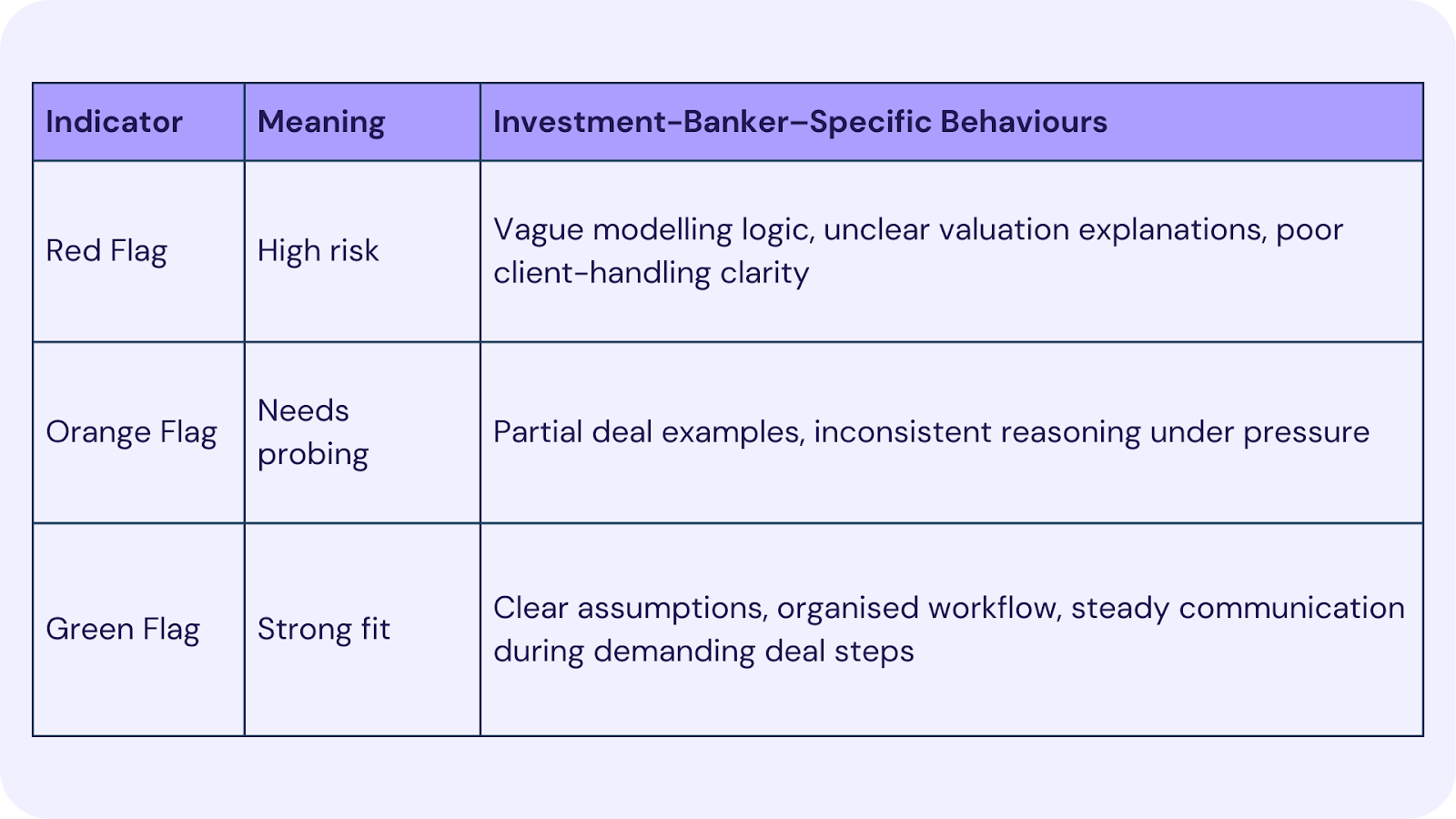

When interviewing an investment banker, ask questions that assess how candidates explain financial assumptions, handle client pressure, and remain accurate throughout deal cycles. Scenario-based questions can help you see how they think when deadlines are tight, valuations change, or negotiations need clear answers. Using a structured table can help HR understand their responses and find bankers who balance analysis, communication, and execution in complex deals.

Bonus Resource: Ask specific Investment Banker interview questions to see how candidates approach decisions that affect both finances and reputation.

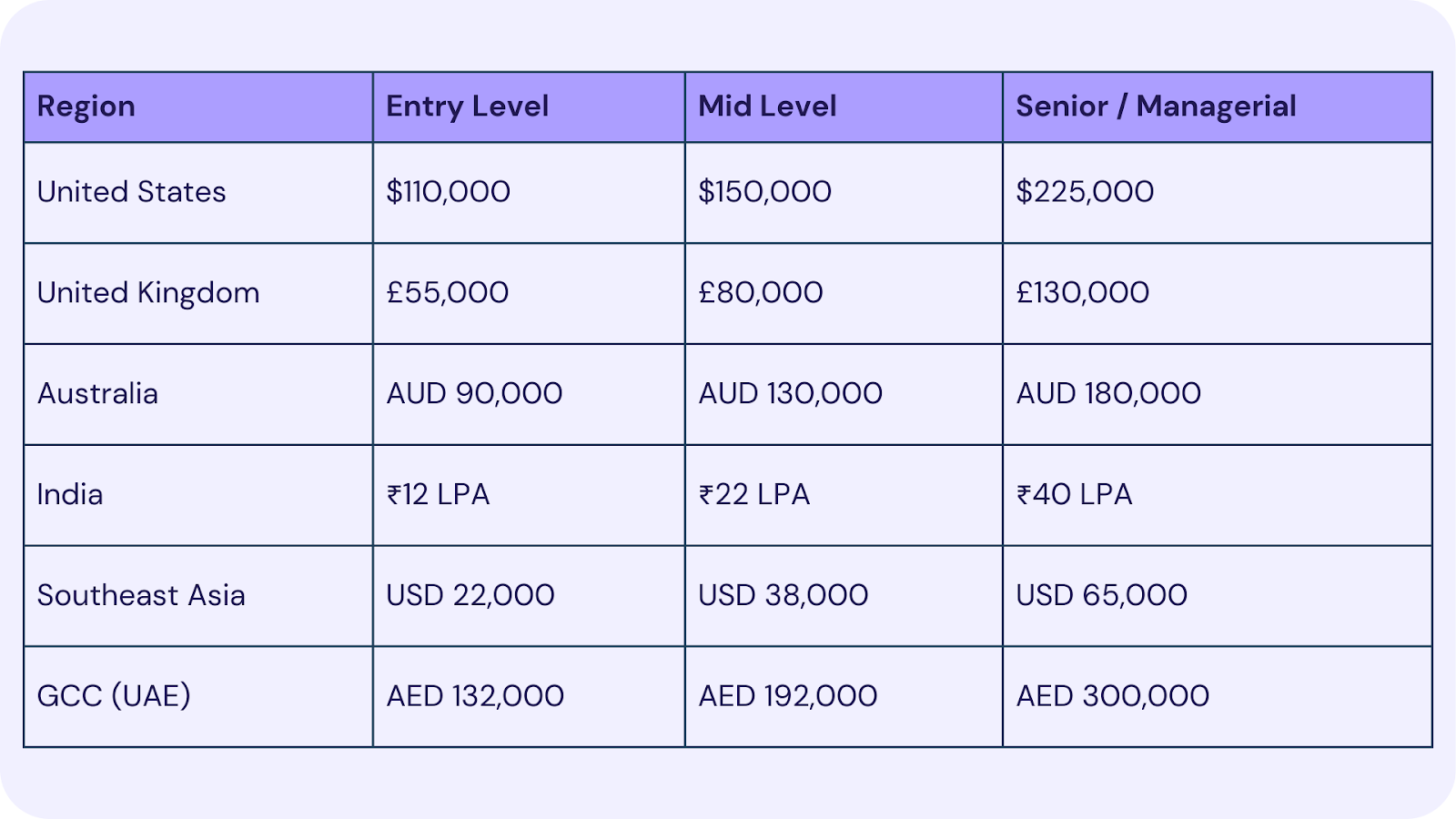

How Much Does an Investment Banker Cost?

When budgeting for an investment banker, it is important to know that salaries can vary by region, team, and experience. Pay also varies depending on the types of deals, the amount of modeling involved, and the level of client interaction required. Benchmarks help HR create competitive offers, keep pay fair across locations, and make hiring decisions for these demanding roles more predictable.

Conclusion

Choosing the right Investment Banker helps your organization manage transactions, valuations, and client commitments with confidence. A good partner offers careful analysis, clear communication, and reliable execution during complex deals. For help evaluating these skills, contact PMaps at 8591320212 or assessment@pmaps.in.